Buying life insurance can feel hard. There are many choices. Each one has different rules and prices. That makes it easy to feel stuck.

That’s why mywebinsurance.com exists. It helps you compare life insurance plans in one place. You answer a few questions. Then you see options that fit your needs.

In this guide, you’ll learn how the site works, what kinds of plans you can get, how much they cost, and who should use it.

What Is mywebinsurance.com?

mywebinsurance.com is a website. It lets you look at life insurance plans from many companies. You don’t have to visit each company one by one. You just fill out one short form.

After that, the site shows you different plans from real insurance companies. You can compare prices, coverage, and terms. Then, you can choose the one that works best for you.

You are not buying the insurance from the website. You are buying from the insurance company. The site just helps you find the best option faster.

What Types of Life Insurance Can You Find?

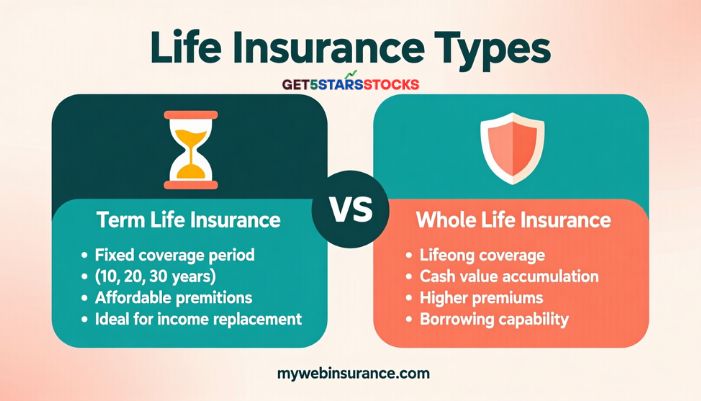

You can find term life insurance and whole life insurance on mywebinsurance.com.

Term Life Insurance

This kind of insurance lasts for a set number of years. You choose how long you want it to last. It could be 10, 20, or 30 years. If you die during that time, your family gets money. If you’re still alive at the end of the term, the coverage ends.

Why people choose it:

- It’s easy to understand

- It costs less than whole life

- It covers the years when your family depends on you

Example:

A 30-year-old may get a $500,000 policy for 20 years and pay around $20 each month.

Whole Life Insurance

This plan covers you for your entire life. It does not end. As long as you pay your monthly cost, your family will get the money when you die. These plans also grow in value over time.

You can take money out later if you need it. But it costs more than term life.

Why people choose it:

- It covers your whole life

- It builds savings over time

- You can borrow from it later

How Do You Use mywebinsurance.com?

Here’s how it works step by step:

- Go to the website.

- Answer some questions.

You’ll fill in your age, health, smoking status, job, income, and how much coverage you want. - See your options.

The site shows different plans that match your answers. You can compare them easily. - Pick a plan.

If you find one you like, click to start the application. - Finish the process.

Some plans ask for a medical exam. Others don’t. Once you’re approved, your coverage starts.

What Makes mywebinsurance.com Easy to Use?

Many people like using this site. Here’s why:

- Fast results.

You don’t have to wait for phone calls or paper forms. - No pressure.

You look at quotes on your own. You decide when to apply. - Many choices.

You’re not stuck with just one company. You see multiple offers. - Simple design.

The site works well on phones, tablets, and computers.

How Much Does Life Insurance Cost?

Prices are different for each person. It depends on your age, health, and other facts. But here are some examples to help you understand:

- A healthy 30-year-old may pay $15 to $25 a month for a $500,000 term policy.

- A healthy 40-year-old may pay $30 to $40 a month for the same policy.

- A whole life plan may cost $150 or more each month for the same amount of coverage.

If you smoke or have health issues, your cost will be higher. If you’re very healthy, your cost will be lower.

Who Should Use mywebinsurance.com?

This site is great for people who:

- Want life insurance but don’t know where to start

- Want to compare prices and plans easily

- Prefer online tools over phone calls

- Want fast answers without extra pressure

If you’re in your 20s to 60s, there’s probably a plan for you. Even if you’ve had health problems, some companies still offer coverage.

Who May Not Need This Site?

You may not need this site if:

- You already have a good agent you trust

- You want to talk to someone face to face

- You need complex financial planning

- You are looking for custom insurance or business plans

If you’re not sure, you can still visit the site. It’s free to check your options.

Is It Safe to Use?

Yes. The site uses encryption to protect your data. Your information only goes to insurance companies that need it to give you quotes.

They do not sell your data to random companies. But you should still read their privacy policy to be sure.

What Happens After You Apply?

When you choose a plan and apply, the insurance company will review your details. They may ask for:

- A phone call to confirm your answers

- A medical exam (not always required)

- Extra documents (like ID or income proof)

Once everything is done, they will let you know if you are approved. If you are, you’ll get your policy and coverage will begin.

Pros and Cons of mywebinsurance.com

Pros:

- Quick and easy process

- No sales calls unless you ask

- Many plans in one place

- No fee to use the site

Cons:

- Some plans still need a medical exam

- Not the best for complex insurance needs

- No in-person support

Final Thoughts

Life insurance matters. If something happens to you, it helps your family stay safe. They can use the money to pay for rent, food, school, or anything else.

mywebinsurance.com makes the search easier. You answer a few questions and see your options right away. You get to choose what works best for your life and your budget.

It won’t work for everyone. But if you want to see real quotes from real companies without sales pressure, it’s a helpful place to start.

FAQs About mywebinsurance.com Life Insurance

1. Is this a real company?

Yes. mywebinsurance.com is a real site that connects you with licensed insurance companies.

2. Can I apply online?

Yes. Once you find a plan, you can apply through the site.

3. Will I get a lot of phone calls?

No. You only hear from the insurer you choose. The site does not sell your phone number.

4. Do I need a medical exam?

Some plans ask for it. Others don’t. It depends on your age, health, and how much coverage you want.

5. How soon can I get covered?

Some people get approved the same day. Others wait a few days. If you need an exam, it takes longer.

6. Is the site free to use?

Yes. You don’t pay to use it. The site gets paid by insurance companies when someone buys a policy.

7. Can I cancel if I change my mind?

Yes. Most policies give you a free trial period. If you cancel in that time, you get your money back.